Open Banking payments is using the wrong GTM

Introduction

‘As soon as a marquee brand embraces OB payments then we will see success’

This is a statement that I’ve heard repeated at all the Open Banking events I’ve been to in the last few years. It’s a hopeful desire for consumer retail adoption and for consumers to magically switch to OB payments. We need to question the ‘build it and they will come’ mindset. I look around the room at the commercial people that I know, and I see doubt on their faces; I don’t believe it’s just a reflection of my outlook, but a genuine shared confusion about the continued hyperbally around what is a poor go-to-market strategy IMO.

I want to lay out a different strategy, it’s nothing nobody else could have considered but rather a challenge of the status quo and logical backing that I don’t see from anyone else on the stage at present.

Executive Summary

Let me just say it – B2C is the wrong GTM for Open Banking payments and we should be choosing a less sexy B2B approach to achieve our goals of getting OB payments adopted. I’m not saying OB payments can’t work for B2C, they absolutely can, but that’s not where we should start. I’m only going to tackle the UK market for the GTM approach because it’s the most ‘ready’ in terms of OB and the ecosystem, but also it’s part of the problem with a B2C GTM strategy.

As it stands today Open Banking payments are far better suited and have greater opportunity with B2B transactions. This is because:

- The B2B payment market is a larger prize

- With B2B you can solve a bigger problem that exists today

- The monetization opportunities are greater due to the problem size and the expensive alternatives

- B2C works well today and is difficult to disrupt

- Consumer adoption is harder than business adoption

- Consumer requirements aren’t met with the current feature set

- Once you get business adoption you can get consumer adoption, since we’re all consumers, the business is the one to many for awareness-driving

Therefore, B2B merchants and B2B software vendors should be the priority for OB payments adoption.

If you still don’t believe me, here’s the one piece of evidence you need.

HMRC has been applauded for its Open Banking payments rollout and adoption, one of the largest applications to date. 90% of its payments are B2B.

You might want to watch my interview with a large B2B merchant who’s successfully implemented Open Banking.

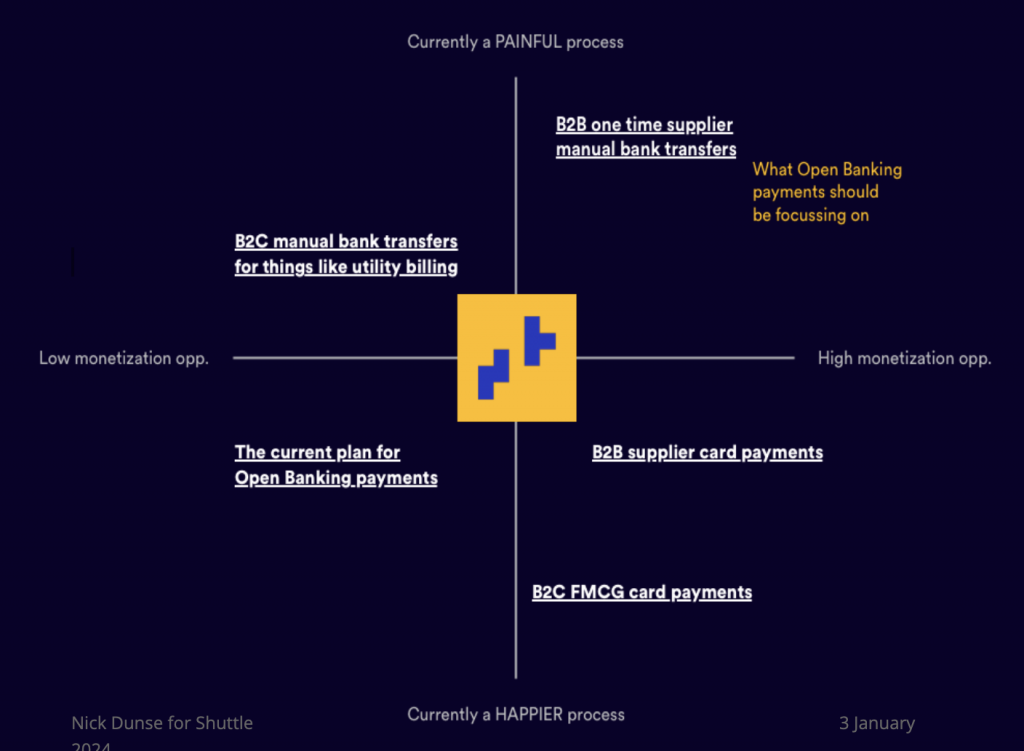

Opportunity Quadrant

3 GTM options for Open Banking payments

3 GTM options for Open Banking payments

- Fast-moving consumer goods, think shopping carts, food ordering

- Slower moving consumer payments, think paying for electricity, broadband, council tax

- B2B invoice payments

Most OB payment companies that I’ve spoken to are favouring number 1, 2 and then 3 in that order.

Number 1 – the most common payment method in the UK is cards, then wallets.

Number 2 – the most common payment method in the UK is Direct Debit or Standing Order.

Number 3 – the most common payment method in the UK is manual bank transfer.

The Problem – why not B2C

Well, you can make your own assumptions from the previous paragraph as to why not B2C; I am now going to expand on those in the following sections.

- Consumers are happy and awash with the payment options today, so why enter a crowded market with a weaker solution (?)

- B2C transactions via other payment methods are competitively priced and Open Banking txns struggle to compete, which in-turn does not create an incentive for the banks or acquirers.

- Adoption by merchants and consumers is at best a chicken and egg situation, at worst it requires a brave merchant who’s willing to spend their money and risk their reputation for little upside

- Distribution and adoption for B2C is a long road and requires mass education

Open Banking payments are account to account but they are also different from A2A payments today. We need to understand where people are today to take them on the journey towards OB payments.

We know —

Most consumers pay with cards

Most businesses pay with A2A (via manual transfer)

Analog to digital

Businesses currently put bank details on invoices that they expect their customer to pay manually. Business A receives an invoice with some payment instructions. Business B logs into their banking provider carefully enters these banking instructions and completes the transaction, hoping it reaches the destination.

Therefore, Businesses are the ones currently closest or most familiar with the account-to-account process today. They are also the ones that are feeling the pain of the cumbersome, slow analogue process explained above. They’re aware they could get their invoices paid via a card in an instant, but they don’t because:

- a) they’ve always done it this way and

- b) don’t want to pay the card fees on larger transactions.

Open Banking payments can/should improve an existing process…

If it ain’t broke don’t fix it!

If B2B invoice payments are currently broken then consumer to merchant payments are currently awash with convenience and options (mostly from by cards). B2C payments are not broken so maybe don’t fix them just yet. I find it very hard to believe that OB payments will disrupt the current consumer behaviour and this certainly won’t happen until OB payments offer convenience, speed and a trustworthy experience. It’s at this point that every OB fanboy (or girl) chimes in and says ‘but they are all those things.’

My friend – they are not.

For OB payments to take ground we need to see a PayPal level of improvement and Apple Pay and Google Pay level of adoption. No successful marketer goes into a saturated market and says ‘hey, this thing over here is better, just try it and you’ll be converted.’ There are so many products and services that have failed with this mindset. The smartphone market wouldn’t be what it is if Blackberry hadn’t paved the way with business users. No consumer needed email or a calendar on their phone but business people had a problem back then, they needed to be able to do more work from more places. Blackberry solved a problem for a particular niche, they didn’t try and disrupt the cool Nokia from the hands of consumers, which, at the time, wasn’t broken.

The state of the market

Any investor will ask a business what’s the size of the market? What’s the size of the prize? We know that B2B commerce is larger than B2C commerce and we’ve already stated that the B2B payment process is ripe for improvement.

As a consumer ask yourself this, do you wish your favourite retailers offered you open banking payments? No, you don’t. But as a business person, you do wish those companies who make you go through analogue bank transfer processes for one-off or recurring payments would make it easier. And if you ever had to transfer money as a small business tell me you didn’t wish that this was easier and faster! Take a look at GoCardless, they’ve been solving this mess for a long time now, limited by the underlying banking infrastructure.

At this point, I’ve neglected to say that OB payments for the B2C GTM could work if there was governmental adoption and incentivisation just like UPI in India. But this is not going to happen in the UK and if it did it would be a closed ecosystem limiting the vision of OB across Europe.

The problem is the category

OB payments in the B2C model is trying to disrupt incumbent payment methods in the payments category with a hope and a prayer that a marquee merchant will force it upon its customers. This won’t work, what has to happen is a new category needs to be defined, and with new category design comes new products and new business models; quite frankly, this is what we’re talking about with OB (and what’s needed). OB can’t compete on price with Standing Orders or Direct Debits, it can’t compete on convenience or adoption with cards, it can’t compete on local or international remittance without massive adoption by the existing technology players and their users.

Tesla’s category is environmentally friendly transport (not cars) and Lulu Lemon’s category is athleisure wear (not sportswear) the OB payments category can’t be Open Banking or Payments. We need to get away from all the payment features and benefit nonsense and talk to businesses about adopting the future of business operations and why that’s different and better than what they have today. This fundamental shift alludes most people that I hear on stage.

Open Banking payments move analogue businesses with cashflow problems and clunky receivables processes to slick digital realities that improve efficiency and get money-in more effectively; thus transforming business. Now that’s more exciting and something we can get behind. Forget the consumer for now.

The Solution – Why B2B and how

“The sheer volume and digitization opportunity in the B2B space is too large to overlook…” – Mckinsey payments report 2023

The difference between GoCardless and all of the new players in the OB aggregation arena is stark when you look at their website. GC talks about getting paid more efficiently, their message is for the merchant, whereas everyone else has an infrastructure or OB centric message. It’s clear that the OB aggregators are going after the integrators, but their sales teams are also (in fact primarily) chasing merchants to adopt their solution.

Payment integration is not a market that we’ll find the Super Consumer in and therefore won’t help these aggregators succeed. Yes, aggregators and acquirers provide scale, but at the moment neither are looking around wanting to provide OB payments because there isn’t any demand from businesses or consumers. We need to drive demand from businesses with our new category and positioning and we need to create the Super Consumer.

“With global payments volume in the B2B sector estimated at $120 plus trillion, B2B payments disruption is huge and growing.” – The Payments Association

The OB Payments ‘Super Consumer’

The OB super consumer is a business that is currently performing manual account-to-account transfers.

We know that OB payments does not yet support variable recurring payments and nobody is quite sure when there will be wide support (a conservative estimate is 2028). This means that we’re not looking at a go-to-market that enables users who can utilize this functionality. That rules out any regular recurring billing either for consumers or businesses.

A Super Consumer is not necessarily a ‘consumer’ but rather the most influential entity that will consume the product or service. Because OB Payments doens’t improve the lives of any actual consumers for one-time payments it’s hard to imagine who this Super Consumer is in the consumer category. Whilst we can imagine the adoption of OB payments by a marquee merchant, they will ask themselves the above question, how does this improve the lives of our consumers over what they currently have, and the answer is – it doesn’t.

Now hold on, I can hear you whispering words like fraud, chargebacks, and account identification services as benefits; but for the consumer use case – none of these things hit hard enough to define a Super Consumer reality for any niche that I can imagine. Quite simply because through ecommerce it’s become very clear who we’re paying with satisfactory checks in place for existing payment methods. Not to mention that fraud rates are going down in Europe for cards. I’m not overruling the benefits for any user but as a GTM communication, they don’t work. We’ve already touched upon the long road that is required to get OB payments into the hands of a Super Consumer in the B2C space, but what is also worth mentioning that the power of Super Consumers is that they multiply themselves and drive adoption beyond themselves, which again is hard to imagine for the B2C option. But it is not hard to imagine in a world of business account-to-account payments, it is inherently viral.

It’s clear that the Super Consumer is the SME business that is manually doing bank transfers for local invoice payments today. The adoption is faster, the multiplication is greater and simpler, and the route to deployment is obvious. That route is via payment links that get placed on digital invoices for the other party to pay. No need for a payment gateway or software integrations. No need to pull consumers away from their already sufficient payment methods. For the B2B invoice process, the benefits of OB payments that are present today can shine and be adopted by the Super Consumer. The payment process is digital and streamlined and the account that is receiving the money is checked and validated with confirmation that the payment has been sent and received. No more manual processes and crossed fingers.

How to get OB payments out there

To expedite distribution and adoption here’s what I would do.

- Target UK businesses that are sending domestic invoices via invoicing software

- Split this into two segments: those that are using corporate cards and those that are using manual bank transfer as a means to getting paid

- Wrap Open Banking with payment link technology i.e. no need for checkout integrations

- Market to the users of X software the benefits of OB payments over manual bank transfers and more expensive card transactions

- Make Super Consumers and advocates

- Move to the next software vendor and repeat

This results in direct ownership of the merchant and the end customer, it provides a direct relationship with the software vendors who are the ones instructing the world’s payments (if not today, they will tomorrow).

Conclusion

I’m sure I’ve hit the argument home hard enough by now. But here’s the thing, we are all consumers, what we experience in our business lives we can adopt in our personal lives and vice versa. And this is why, when OB payments is ready with features that consumers need then many of us will be Super Consumers of OB from our business lives and can make the adoption in our personal lives.

The familiarity of account-to-account methods for businesses is the grease we’re looking for. The tolerance for a business to try and use OB payments is far greater because:

- People are used to a more cumbersome and untrustworthy opaque process

- People have the time to sit down and make a payment as they tend to batch invoicing payments currently, which means there’s less pressure on the experience.

We can’t jump straight to consumer adoption for Open Banking Payments, we need to target businesses who have a problem with manual bank transfers and corporate cards today, so they can improve their cashflow and be more efficient. The problem is big and therefore can be monetized which means the value chain and different players can be incentivised to build, release and support Open Banking.

What can Shuttle do?

Shuttle provides payment infrastructure to some of the world’s leading software vendors and connects leading payment services. This means that a payment service can go to market with one integration. Open Banking Payments could appear in thousands of checkouts quickly. There’s no need to integrate into payment gateways and no need to integrate into software vendors. This accelerates the GTM opportunity.

Shuttle already has a number of B2B invoicing platforms onboard, as well as shopping carts, ERPs, ticketing, booking etc. At Shuttle we know what sectors and use cases are ripe for solving, who is currently hurting with high card fees or manual processes. If you want to go to market quickly, educate an audience and test this hypothesis Shuttle is the best place to start. Please get in touch with nick@shuttleglobal.com.

3 GTM options for Open Banking payments

3 GTM options for Open Banking payments