Find out which Payment Providers will save you money and convert more sales

COMPARE — Payment Gateways, Merchant Accounts and more.

TRUSTED BY 30K MERCHANTS GLOBALLY

To process a debit or credit card in the UK you will need a few things:

- A merchant account

- A payment terminal

- Or a payment gateway

- An all-in-one-service that does all the above like PayPal

There are two types of card fee models in the UK:

- Blended rate or Fixed fee. Companies like Stripe, Square and PayPal offer this model.

- Interchange ++ Companies like Adyen, Checkout.com and Ecommpay can offer this model.

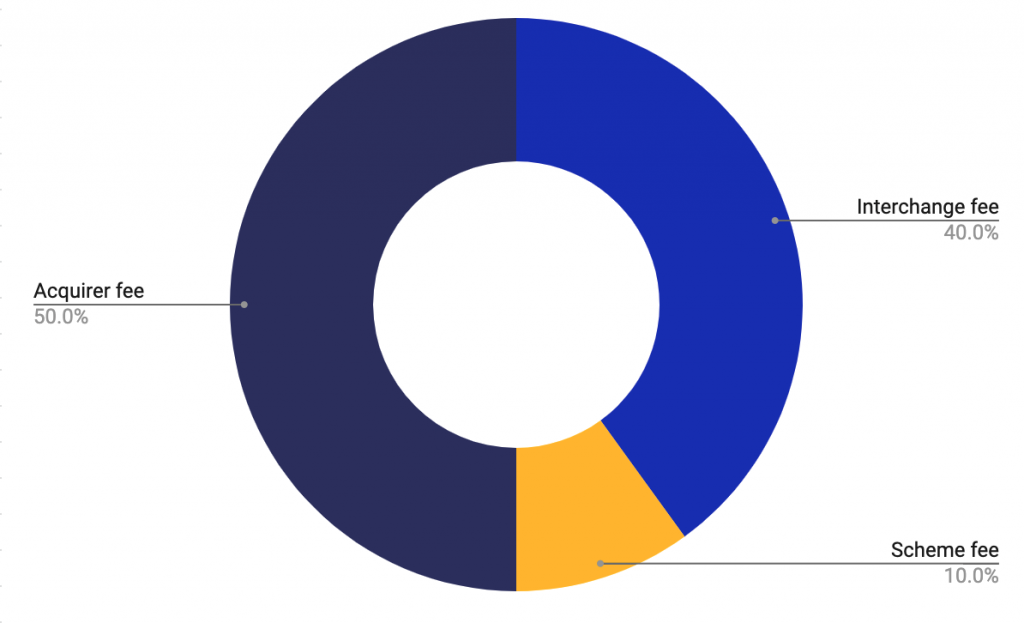

Both models they are made up of various fees, known as Merchant Service Charges:

- Interchange Fees

- Scheme Fees

- An Acquirer Fee which may or may not include a gateway or other fees

Here’s an example of the card processing fees calculation

0.3% (interchange) + 0.8p + 0.02% (scheme fees) + 0.6% (acquirer fee)

How are acquirer fees calculated?

The acquirer charges these fees to cover their fees and profit margins. Alternatively, they may be referred to as processing fees or acquirer markups.

It is possible to negotiate down acquirer fees

As processing fees vary so much depending on the acquirer and other factors outlined below, it is impossible to give a typical figure. In general, most processing fees fall between 0.8% and 2.6%.

It is likely that the processing fees will include both the fees retained by the acquirer to cover their costs and profit margin in addition to the commission paid by the acquirer to the merchant service provider if a merchant was not recruited directly by an acquirer but by a merchant service provider (i.e. an ISO like Paymentsense or payment gateway provider). A commission is paid to find, onboard, and manage the merchant relationship.

How do interchange fees work?

When a card is used to purchase goods or services, card acquirers pay card issuers transaction fees. A fixed percentage is usually charged and cannot be negotiated.

For UK consumer cards, interchange fees are typically 0.2% for debit cards and 0.3% for credit cards. Commercial cards have higher interest rates.

The main factors determining the level of interchange fees are:

Each card scheme or network (MASTERCARD, VISA AMEX etc) charges different interchange fees.

The difference between card-present and card-not-present (CNP)

A card-not-present transaction, such as one conducted over the phone, online, or through a virtual terminal, is often considered more risky than one conducted in person, so interchange rates are typically higher.

Merchant category code (MCC)

MCCs are four-digit codes used by credit card companies to categorize businesses. Interchange fees may be lower for businesses in a low-risk category.

Consumer cards vs. Commercial cards

Interchange fees on commercial cards are typically higher than those on consumer cards.

A regional approach to transactions

Transactions conducted within the same country as the card-issuing bank or organization are usually less expensive than those conducted internationally.

Card authentication

Interchange rates can also be affected by how a customer authenticates (e.g. chip and PIN, contactless).

Reward cards impact fees

Last but not least, reward cards are another key factor that influences the interchange rate. Interchange fees are higher when customers use a reward card to pay for goods or services; rewards have to be paid somehow!

Limits on Interchange fees

Interchange fees can be quite complex, but they are all published online.

In December 2015, the Interchange Fee Regulation (IFR) changed to allow interchange fees to be capped on most card transactions (typically 0.2% for debit and 0.3% for credit,m in the UK).

Due to the UK’s departure from the European Economic Area, MasterCard and Visa revised interchange fees for UK-EEA transactions from October 15th 2021.

Scheme fees

To cover their maintenance costs for providing their payment networks, card acquirers pay scheme fees to operators of card payment systems (MASTERCARD, VISA, AMEX)

Assessment fees, cross-border fees, clearing and settlement fees make up the total scheme fee. The total amount charged depends on the type of card used and the location of the acquirer.

Fees are fixed and non-negotiable and consist of a payment technology fee and a base fee. These fees are determined by:

- Type of card

- Type of transaction (card present or card not present)

- Authorisation fees

- Transaction volume/size

- Cross-border transaction costs

- Licensing fees

- Scheme/network fees for reports

- Anti-money laundering processes and fraud prevention

- Marketing and innovation funds

Just an example of card processing fees breakdown

Non-transactional processing fees

There are also several non-transactional fees that might be charged like terminal rental, payment gateway fees, compliance, refunds and chargebacks to name a few!

Typical card processing fees

These vary significantly depending on the size of the card turnover, the industry, the country and the business model of the merchant.

In general, there is a strong relationship between the MSC fee and the level of card turnover.

Why can’t I find most card processing fees online?

Most acquirers and ISOs provide bespoke quotes and don’t have fixed fees. Payment processing fees will be determined by several factors and they will require proof if you’re already transacting, these include:

- The total value of transactions the business accepts per year

- The average transaction value (ATV) of the business

- The range of card types the business accepts

- The source of payments (i.e. face to face, online, MOTO)

- The merchant category code (MCC)

- The sector the business operates in and whether this is deemed riskier

How to negotiate the lowest card processing fees

It is possible to negotiate on fees and your sales rep will have scope to do so based on the factors above, but most importantly the total value of transactions and the risk profile of the business will be the determining factors. You won’t be able to begin neogtiating if your processing is less than £50k per month.

Due to the number of fees involved and the fact that every business is different, the lowest fee may not actually be the most effective. It is not actually the most affordable when compared to other providers or technology when you take into account total cost of ownership.

The difference between a blended (fixed) rate and interchange ++

Standard / blended pricing

Interchange and scheme fees are not automatically passed through by the acquirer or ISO at cost price. When they publish the merchant service charge (MSC) on monthly statements, they don’t separate the interchange and scheme fees.

IC+ pricing

The acquirer automatically passes on the interchange fee applicable to that transaction to the merchant. Scheme fees are not contractually passed on at cost.

IC++ pricing

In any given transaction, the acquirer passes on interchange and scheme fees at cost to the merchant (so the processing fee covers the acquirer’s other costs plus their margin). Due to the transparency of this fee structure, it is normally only available to businesses with a high card transaction volume.

Fixed pricing

As long as card turnover stays below certain limits, the amount paid for every consumer present transaction is fixed.

Low card turnover businesses tend to prefer these credit card processing fees regardless of their relatively high rates since no minimum term contracts are required.

Of course larger merchants generally pay lower fees as the acquirers are happy to reduce their margin due to them expecting to make their own profit over time on the volume.