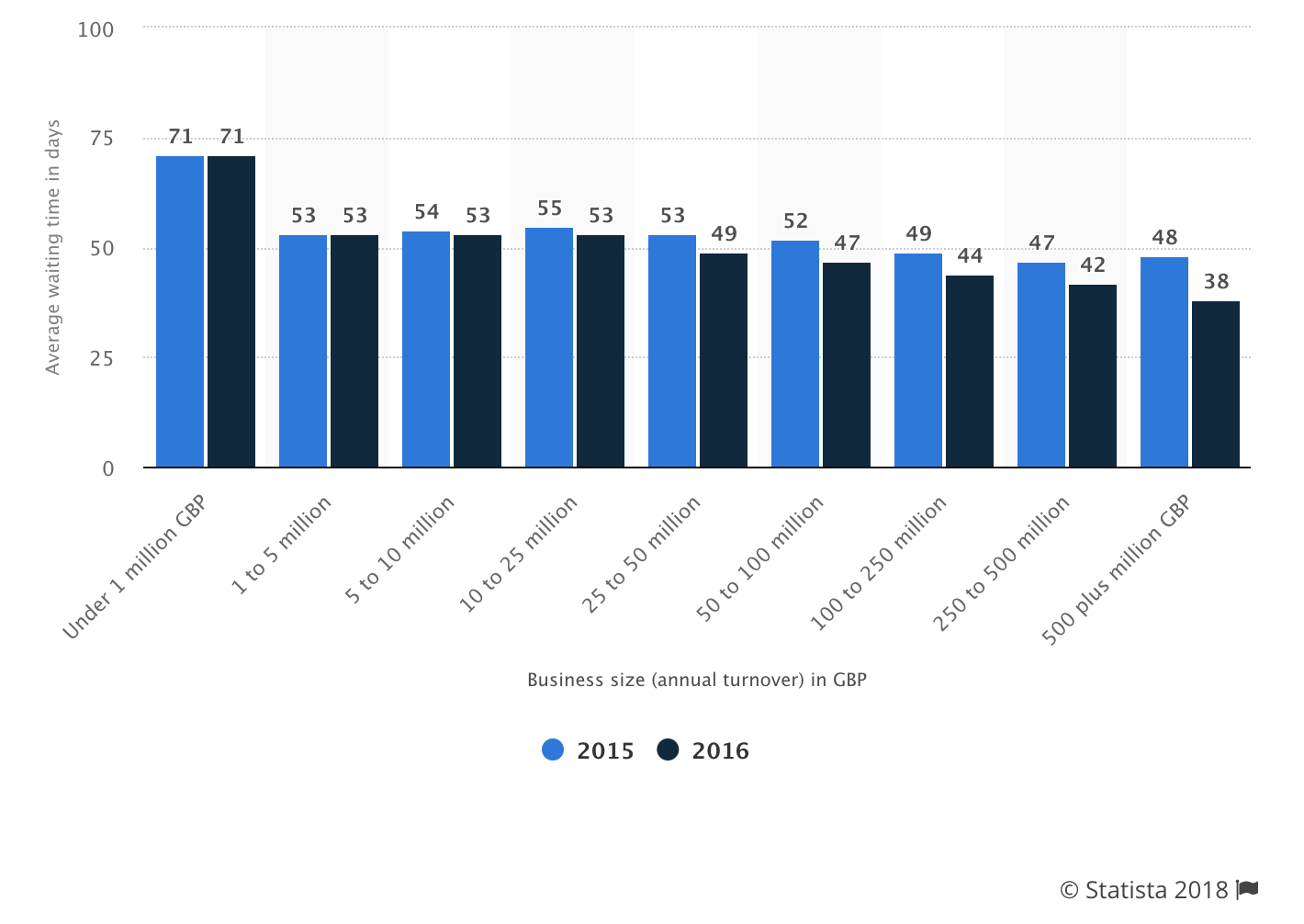

Nobody likes to wait, especially when it’s related to getting paid. The average waiting time in the UK for an invoice to be settled for an SME is 71 days.

71 DAYS!

I suspect this is the case across most western business territories. Waiting to get paid is downright expensive and detrimental to the health of your business.

You probably know the phrase that ‘cash is king’ and you’ve probably been encouraged by your accountant and mentors to reduce invoice payment terms down as much as possible, ideally payment on receipt of invoice is best. There are a number of ways to achieve this ideal outcome:

- You don’t take on any new customers who won’t accept these terms. Stand strong, put your stall out and good luck to you with this one.

- You get your customers on a flexible direct debit. This is great since there are no fees attached to DD, but there are some challenges with this method:

- Convincing your customer to agree to a flexible DD is not easy

- Doing the admin for this requires reasonable amount of time and effort up front

- You can use a payment gateway like GoCardless to reduce the admin but they will charge you a fee

- The major pain for DD is they are often slow to when it comes to receiving/clearing the first or subsequent payments and you have to have another system to validate the payment has been made.

- When you send the invoice over you hit the phones. This could be seen as a little aggressive by your customers, it’s likely to be time-consuming for you and unlikely to yield immediate results.

- You offer incentives for faster payment via BACS, maybe a 10% discount if paid within 1 day. This is good but it might still be hard if the organisation you deal with only makes payments once per month with their ‘bank run.’

You’re giving it away!

If you’re a service provider with reasonably sized invoices it’s a good idea to split your projects into bite-sized chunks and invoice inline with those deliverables; but again, if you have a client on 30 day terms you’ll be well underway with the next phase and still be at risk of not getting paid on time if at all. You should never leave more than 10% of the total bill until the end and you shouldn’t send a deliverable until payment is made, that’s what happens when you go shopping right? Most shops don’t let you walk off with the goods unless you’ve paid or signed a payment scheme contract.

The problem is that none of the above really solves the issue of getting paid quickly and addresses how to give the people that are paying a simple, pleasurable experience when making that payment, meaning alongside being happy with the product or service they enjoy paying you. Ok, enjoy paying you is perhaps a little far-fetched, but I actually think companies like Amazon have made buying stuff rather too easy and potentially addictive.

So having said all that, what if we could leverage the type of experience that, us as consumers are used to, paying with our debit and credit cards. Paying from our mobile, paying from anywhere. There are currently a few options out there from companies like PayPal and Stripe. With PayPal you can use PayPal.me and create your own payment link to your unique URL, obviously, you have to have a PayPal account and the money gets deposited in there for you to withdraw. Stripe do things slightly different and call their system Stripe Checkout. You drop the Stripe checkout code on to your website and direct your customers there to pay you, either a one-off or recurring payment, plus saving cards is possible. In the age of mobile banking and e-commerce you’d think that making payments online for products and services would be easy, well these two solutions certainly go some way to making that a reality, pay others quickly and expect to be paid quickly in return.

The issue comes when you have an existing relationship with a merchant account or payment gateway provider that don’t have the plug and play options like Stripe or PayPal. Having used other providers’ options, if they offer them, is like using an online children’s cash register with a pedantic nature. They’re not very nice!

What if you could have an independent payment layer that accepted card payments, created a best of breed experience and was open to embrace future payment developments and methods. That would be great, wouldn’t it? Having your invoices settled with the same enjoyment as sliding that Amazon purchase button. The bottom line is that the world of payments is still too complicated and fragmented, for the most part, it’s far behind in its approach to satisfy a savvy, demanding population. This is what fueled us to start the journey in our vehicle Pay with Bolt, an independent and best of breed payment solution, allowing businesses to get paid immediately online by accepting card payments (and beyond). Pay with Bolt is not for the people who like to pay their friends at the last possible moment, Pay with Bolt is ideal for businesses with higher volume invoices, with lower payment amounts, who want their customers to enjoy the payment experience again and again. Let’s see those invoice settlement days come down!