Find out which Payment Providers will save you money and convert more sales

COMPARE — Payment Gateways, Merchant Accounts and more.

TRUSTED BY 30K MERCHANTS GLOBALLY

At Shuttle, we work with an increasing number of payment service providers and payment gateways, we also track many data points on hundreds of payment providers and payment methods. In fact more than anyone else in the market, that’s how we can create this definitive guide. There are so many options in the market and businesses are confused about the best option – You can go ahead and use our payments marketplace to compare payment service providers to find the right one for your business. Visit our payments marketplace now.

How to decide who’s the best payment service provider?

Really the question is who is right for my business? Since payments are no longer a commodity, they are no longer, all the same, each payment provider has different features, pricing, customer service and industry focus. That means that there are better and worse options for your business based on your needs. Below we’ll show you who are the best payment providers based on those themes.

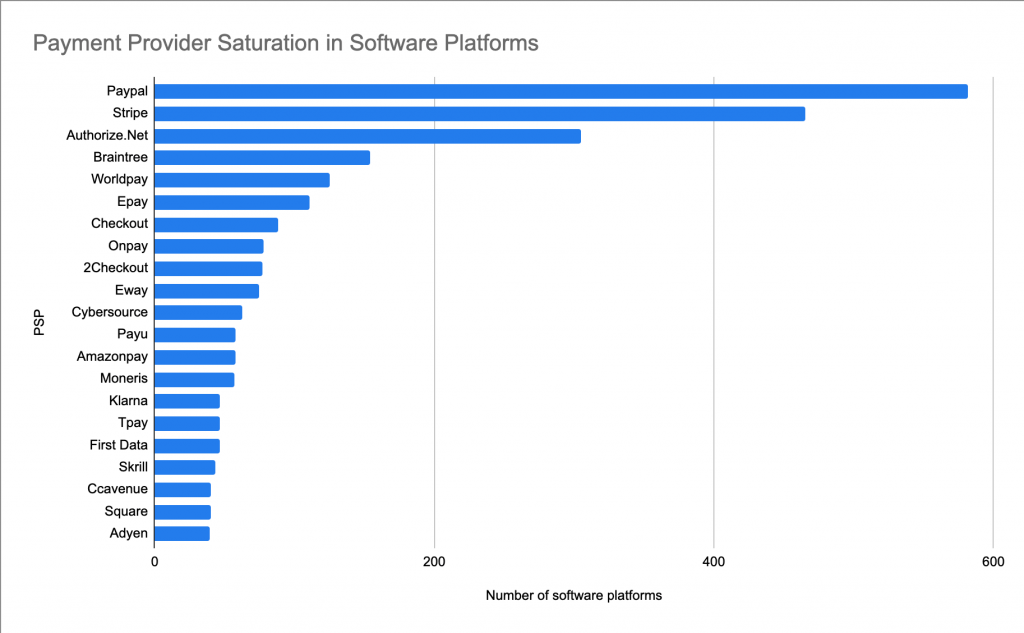

Platform availability

The often overlooked but really most important factor is access and availability of payments. Since your business will be using off the shelf software to take payments you will need to ensure from day one that your chosen service provider is compatible with all your software. These payments use cases could be your online shopping cart, your in-store terminals, back-office invoice payments or even payments via phone and snail-mail. Below are statistics gathered from Shuttle on the most widely integrated payment gateways by software platform type.

Customer service

We find that customer service is one of the major reasons why merchants search for a new payment service provider. It might be that their account has been locked or frozen and they can’t take payments, or something less dramatic like they no longer have an account manager to speak to. To get the best out of customer service you should ask yourself what kind of relationship do you want with your payment provider. Do you want an account manager or would you prefer to get everything virtually and talk to the team on chat when needed. It’s rare that you can find a provider that has booth everything you need from the interface as well as strong account management. Of course, anytime account management is involved there are likely to be cost implications somewhere, but this may be the best thing for you. We’d highly recommend closer account management and service if your business is high(er) risk, has peaks of payments or is in certain markets.

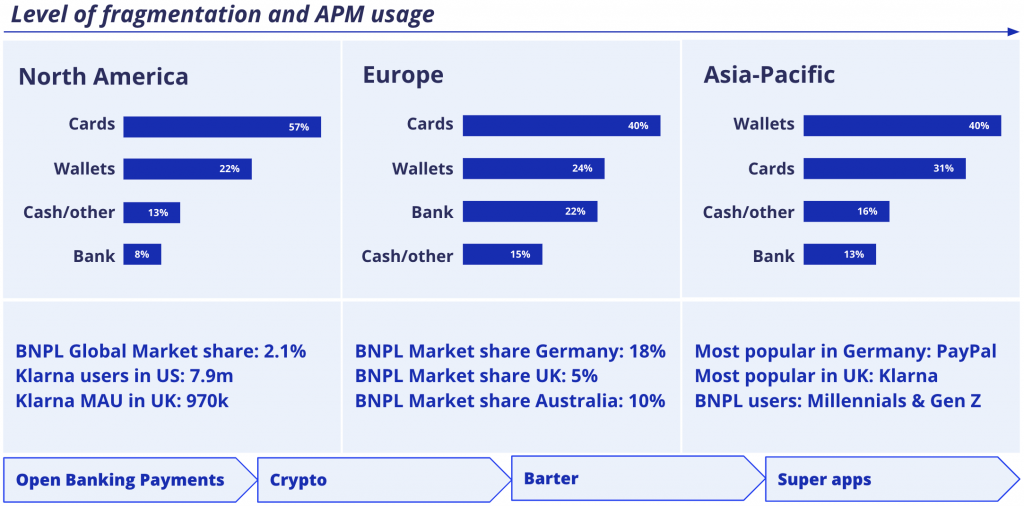

Alternative payment methods

Not sure that some payment methods should be still called ‘alternative’ since they are the primary method of payment in some markets, the use of cards across the globe is not a given and certainly under some pressure with their higher fees and fraud challenges. It’s very likely that you’ll need to use APM’s and that’s either because new younger buyers have adopted them or the country you’re selling in prefers them. Can you increase sales conversion rates if you add Apple Pay, Google Pay, Buy Now Pay Later and PayPal?

Not sure that some payment methods should be still called ‘alternative’ since they are the primary method of payment in some markets, the use of cards across the globe is not a given and certainly under some pressure with their higher fees and fraud challenges. It’s very likely that you’ll need to use APM’s and that’s either because new younger buyers have adopted them or the country you’re selling in prefers them. Can you increase sales conversion rates if you add Apple Pay, Google Pay, Buy Now Pay Later and PayPal?

- Work out where you need to sell and who to?

- What are the relevant payment methods for that country/region?

- What are the relevant payment methods for your demographic?

- Do you need a combination of payment methods at checkout?

- It’s likely you’ll need two PSPs due to BNPL

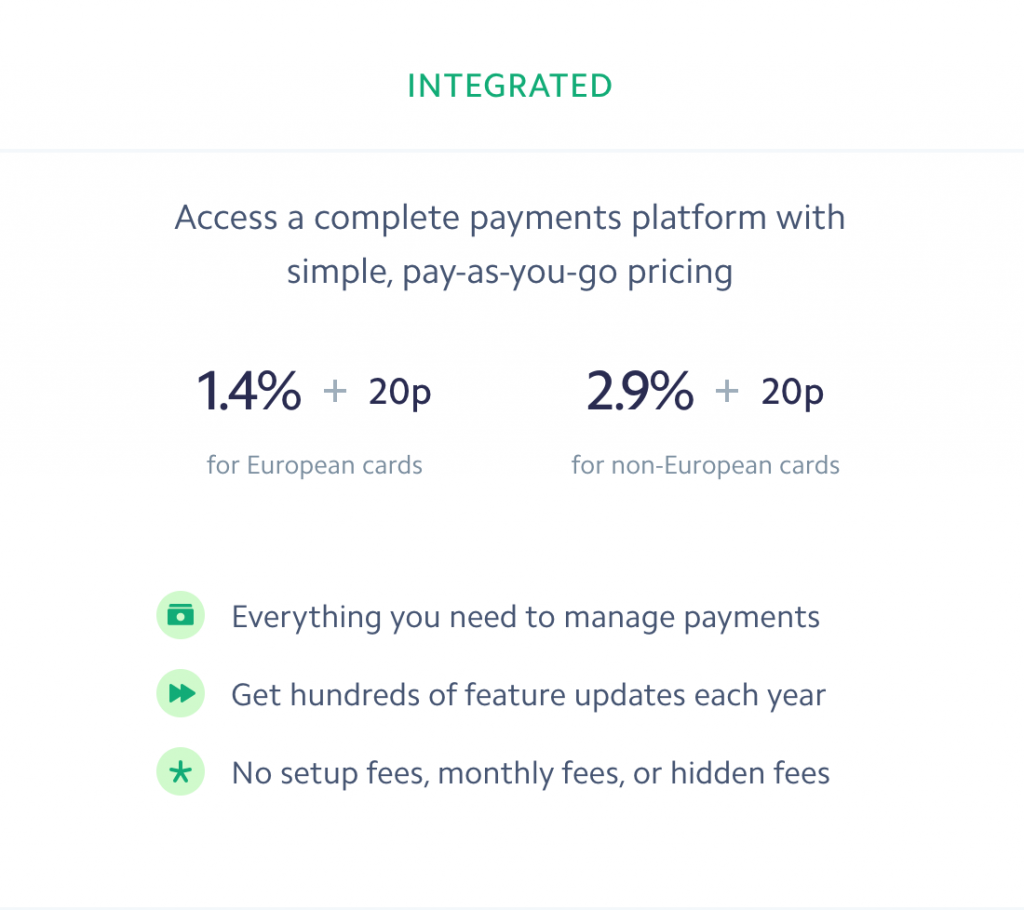

Pricing

Everyone wants cheaper payment processing and using alternative payment methods might be the best way to achieve that whilst improving speed of payment. Some payment methods like Open Banking or those methods that fix the transaction fee are great when the payments are slightly higher. But of course we know that cards are still very convenient for many, even for B2B transactions, not to mention the ‘points’ opportunities that some enjoy. So are the ‘cheapest’ fees really best for you and are they really that cheap? Well, the answer is possibly not, now you really need to be considering total cost of ownership and working out the total cost of selling. We see extra fees added for all kinds of things, gateway fees, service fees, feature fees… Here’s what you should look at when considering fees and the price of payments:

- Consider the bigger picture with price, don’t just go for the lowest card processing: connected, efficiencies, FX, hardware ownership

- Maybe fees go up but so does conversion rates?

- Is Interchange + pricing better for you than a blended rate?

- PSPs can change pricing on you if behaviour changes!

- Custom pricing is not usually available if you process less than £50k

- Some PSPs can go low on pricing because they are also the acquirer/payment method

Card processors can offer two types of pricing, the first is called ‘a blended rate’ the second is ‘interchange plus (plus)’. Blended rates are a fixed rate for domestic and international sales regardless of card type; because the card schemes (AMEX, Mastercard, VISA) all price card types differently, a corporate card transaction is more expensive than a local debit card. Blended rates are not good if all your business is on local debit cards, you’re overpaying. But this pricing is more predictable. Interchange plus pricing means that whatever the card schemes charge your service provider will mark that up and pass the cost to you, for example 1% + 0.3% + £0.20. Typically interchange plus pricing is for mature business and cheaper. For free try our payments marketplace and compare payment service providers to find the right one for your business. Visit our payments marketplace now.